I am so happy to see my country Barbados arrive at a major milestone, celebrating Fifty Years of Independence!

Though I have only lived to see thirty-three years of Barbados’ development, I have learnt and understood that in order to move this nation forward, you must have vision. This means the same for your personal development, that of your family and those who you lead.

Early in my twenties I lacked vision. In 2005, I signed my first employment contract which guaranteed me a salary at the end of the month. I was exhilarated of course, because I could now earn a living for myself. I thought I had finally achieved a level of financial independence; or so I thought. Those of you who have heard me speak, I often refer to the concept of financial leadership. I will explain how this revolutionised my finances.

You see, I was seriously bankrupt in my understanding of money. Yes, I got paid, but I lacked the maturity to manage it. As I grew in my understanding, I realised that the money was not my issue. It was my behaviour. I thought I needed more, but I had to behave better with my money. Financial leadership is the ability to give your money PURPOSE and DIRECTION. It meant at the tender age, I had to kick against the grain and make decisions that could positively affect my future financially.

It meant I had to grow up on that day I opened my laptop and started budgeting my money. I didn’t like to be disciplined. It was absolutely not my favourite thing to do, but soon this painful habit became one that I cherished greatly.

Often times, it is easier to look at the present and not take a peek into the future, especially in financial planning.

Do you know, that if you don’t set aside money for spending later, you are stealing money from yourself in the future?

Let that sink in for a minute.

Could you confidently say you are actively planning for future generations to come?

This isn’t meant to condemn you, but to cause you to think very carefully about the financial decisions you make.

You might be saying, “I am knee deep in debt.”

You might be saying, “I have experienced a job loss.”

You might be saying, “I have made too many mistakes with my money. How could I possibly think about my financial future and that of future generations?”

You could start over with my thoughts on leaving a legacy of independence:

- Understand leaving a legacy is not only about leaving money: You can breathe now. You are not entirely responsible for your next generations’s financial future. Giving your next generation the tools and knowledge to creating a healthy, financial future is part of leaving a legacy.

- Embrace and encourage individuality: The truth is, everyone of us is wired differently. If you want proof, we all have unique fingerprints and will not walk the same financial path. Not everyone will earn money being a doctor or a lawyer (and I mean no disrespect to the profession), but we all were born with abilities which could earn ourselves a living.

- Refocus your goals: Is it the financial path of someone else you are walking on or desiring to walk on, or are you embarking on your unique financial journey? Unfair comparison kills our financial momentum I am afraid to say. If you are trying to build your life based on the perceived benefits from someone else’s path, you will be unhappy. Find out what you want to achieve for yourself and your family.

- Have the future in sharp focus: Transform your financial landscape by the way you think about and view money. See money as a tool. It is not a item you throw away haphazardly. Make wise use of it by investing in yourself for healthy returns. For example, your education, investments, businesses. Developing the habit of investing could transform your financial world, for the benefit of yourself and the generation that will come after you.

Happy Independence

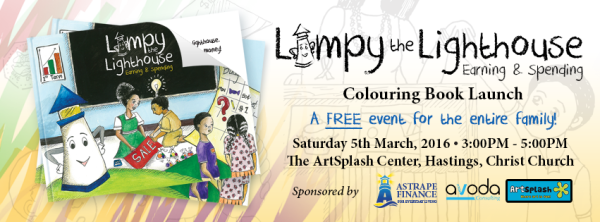

Melinda Belle is the visionary and founder of Astrape (As-strap-pay)  Finance, the caring, knowledgeable, trustworthy, financial company guiding you to financial stability and prosperity through education, sound planning and advice. Melinda sees her role as that of an architect and is committed to the shaping of financial landscapes of businesses. She also crosses over to the personal side of finance, teaching families and individuals to manage their money and create wealth.

Finance, the caring, knowledgeable, trustworthy, financial company guiding you to financial stability and prosperity through education, sound planning and advice. Melinda sees her role as that of an architect and is committed to the shaping of financial landscapes of businesses. She also crosses over to the personal side of finance, teaching families and individuals to manage their money and create wealth.

EMAIL her at: melinda@astrapefinance.com

LIKE her Facebook Page:www.facebook.com/AstrapeFinance

FOLLOW her on Instagram: moneymatterswithmelinda

FOLLOW her on Twitter:www.twitter.com/MelindaLBelle

individuals can claim as an income tax deductible. During his budgetary proposal, the Minister of Finance, Rt. Hon. Christopher Snickler stated that individuals can no longer claim the following as income tax deductibles:

individuals can claim as an income tax deductible. During his budgetary proposal, the Minister of Finance, Rt. Hon. Christopher Snickler stated that individuals can no longer claim the following as income tax deductibles: